Mastering SaaS Performance: A Guide to Building Comprehensive Growth Metrics

Situation

Compared to businesses with mostly transactional relationships, such as finance and eCommerce, SaaS companies face unique challenges when it comes to managing their metrics. The sheer volume of activities to analyze, including web traffic, signups, email clicks, link clicks, payments, and usage slowdowns, can make it difficult to stay on top of key performance indicators.

While the founding team typically focuses on core metrics such as new revenue, recurring revenue, LTV/CAC, new users, active users, and paid users, identifying the root cause of a slowdown in any of these metrics can quickly turn into a never-ending, all-hands-on-deck situation that costs time and morale. Furthermore, some of the data required for analysis may not be readily available and would require engineering work to lay the foundation before any insights can be gained.

As a result of these constraints, decision-makers may make decisions based on incomplete insights that could lead to suboptimal results and fail to maximize the product's growth potential. For instance, they may decide to focus on retention if recurring revenue is softening or test a competitor's approach without fully understanding its relevance to their own situation.

To address these challenges, we need a framework to simplify the process of identifying the root cause of revenue growth slowdowns. By asking the right questions and focusing on what matters most, we can quickly identify the problem and take action to bring growth back on track.

Solution

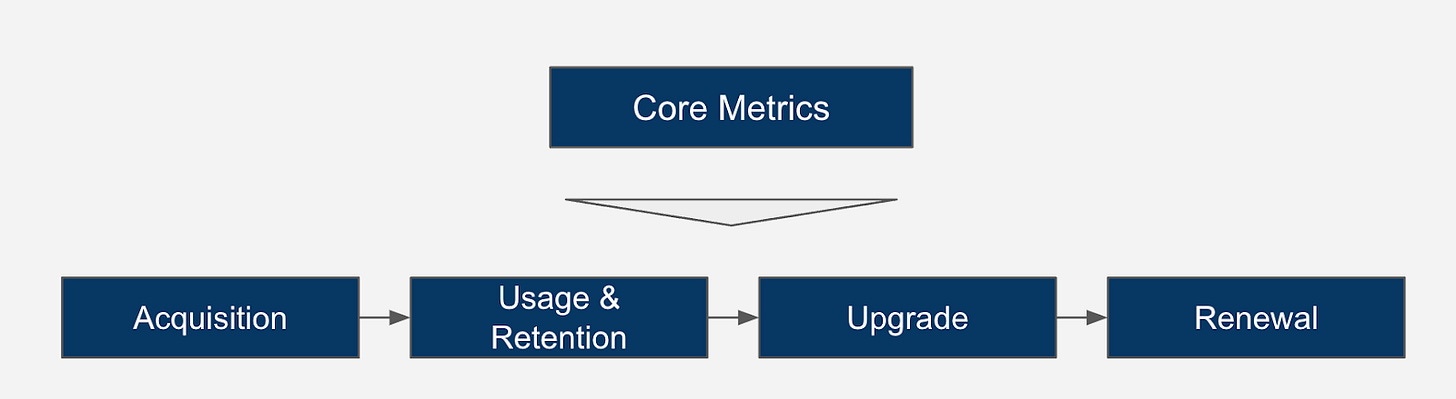

A simple growth metrics framework can help break down high-level core metrics into four key parts: Acquisition, Usage & Retention, Upgrade, and Renewals.

Core Metrics

To refresh the memory, the core metrics refer to a set of highest-level metrics that the founding team often cares about the most because they need to present them to the board or investors. These typically include Total/New/Recurring Revenue, New Users, Total Active Users (weekly or monthly), New/Total Paid Users, Spend, LTV/CAC, and more.

When presenting these metrics, it's common to include the absolute value (# or $) and YoY (or MoM) growth rates based on a reference point.

However, it's worth noting that almost all of these core metrics are lagging indicators. They tell us what has happened due to all the inputs we've already put in. To identify the root cause of these outcomes and take corrective action, we need to go upstream and analyze key growth drivers.

Acquisition:

Acquisition metrics are key indicators of how effectively a company attracts new customers or revenue. To measure acquisition, we need to look at several key metrics:

Spend: This measures how much we spend on marketing activities and how that spend varies across desktop and mobile platforms (assuming the app has both versions) and marketing channels.

Outcome: We typically look at direct results from marketing activities, such as website traffic, new free and paid users acquired, and new revenue that are highly correlated to the spend.

Efficiency: To ensure that our acquisition efforts are cost-effective, we need to monitor metrics such as cost per user, cost per paid user, ROAS (Revenue over Ad Spend), or the inverse (Spend/New Revenue), and ultimately LTV/CAC.

It's worth noting that this Acquisition section overlaps heavily with the above core metrics and includes metrics that are not only affected by marketing activities (such as paid users/upgrades and new revenue). In the next sections, we'll add more granularity to our analysis to gain deeper insights into our acquisition efforts.

Usage & Retention

Usage and retention metrics are critical for measuring how engaged your customers are with your product and how likely they will continue using it over time. These metrics dictate everything about the future revenue that comes as a result of the product benefits.

First, we need basic measures of how often and recently users have engaged with the product. For example, we can look at 4-week usage retention (are users still active at the 4-week mark), 12-week usage retention, and more. Depending on the product, we can adjust the intervals accordingly to be shorter or longer. It's also important to look at usage separately for free and paid users because these are fundamentally different groups.

Beyond the basic recency and frequency usage metrics, we need to dive deeper and understand how users engage with specific features that are often leading indicators of future engagement. For instance, we can ask:

How many of the top product features were used by users in the past 7 days?

How many of the top product features were used by new users in the past 7 days?

What percentage of all active users engaged with the top features in the past week?

What percentage of new active users engaged with the top features in the first week they joined?

What would you consider a "good session" for product usage?

How many good sessions happened for all users/new users in the past day/week/month?

How are users engaging with the desktop/mobile version of the product or other platforms within desktop/mobile?

For a typical SaaS product that tends to have many button clicks, there could be unlimited possibilities for metrics to monitor. It's important to use business intuition and objective customer insights to determine what critical information to monitor on a daily/weekly basis that can tell us 80% of the story with 20% of the effort. For product teams responsible for specific features, there might be a need to go 10 levels deeper and analyze all the details.

Upgrade

Upgrade metrics are critical for measuring how successful your company is at convincing existing customers to upgrade to higher tiers or additional products.

To gain insights into upgrade metrics, we need to know how many are first-time upgraders and how many are returning after canceling the service due to budget, timing, or other reasons. We also need to know how long it takes for someone to upgrade. Typically, users with different pricing plans represent different needs, so we want to look at upgrades by plan type (for example, Grammarly users with monthly/quarterly plans are more likely to be students because they don't want to pay for summer months).

In addition to these metrics, we need to identify the right leading indicators to predict how upgrade rates might change in the future. For instance, knowing how the current user segments distribute/trend by key dimensions (such as student/professional) would give us insights into whether upgrade rates might go up or down, so we don't get surprised when the shift happens. Product usage information tracked in the prior section is often the best indicator. If the situation allows, a simple scorecard or predictive modeling could be used to quantify the future upgrade rate change.

By analyzing upgrade metrics and identifying leading indicators, we can better understand our customers' needs and preferences and make informed decisions to drive more upgrades and revenue growth.

Renewal

Renewal metrics are critical for measuring how well your company retains customers and ensures they continue renewing their subscriptions.

To gain insights into renewal metrics, we need to look at renewals by plan types because they often represent distinct user segments and needs. For example, annual and monthly plan users would most certainly have different willingness to renew, so it makes sense to look at them separately. Another reason to separate them is the time intervals: annual plans renew every 12 months, and monthly plans renew every month. Therefore, the typical retention table used to analyze paid retention/renewal for each time interval is only meaningful when one period means the same thing: for annual plans, one period means 12 months, and for monthly plans, one period means 1 month.

In addition, it's helpful to identify leading indicators to anticipate better what might happen. For renewals, having the paid users mix by key segments (such as annual/monthly plan types) is helpful. Similarly to the previous section, product usage by paid users often indicates renewal behaviors so that we can adopt the analytics approach for monitoring purposes.

Summary

The benefits of having a metrics system are clear: it provides the team with the right clarity on overall business health, enables alignment on where the biggest opportunities lie, and helps prioritize scarce resources to focus on high ROI initiatives. Additionally, the team can quickly identify where things might go wrong and find the right fix.

While utilizing this framework, there are other things to consider:

Automation is extremely helpful. Generating all these metrics by hand regularly can be resource-intensive and expensive. By automating these processes, you can save time and reduce costs. Be sure to build a good relationship with your data engineers or BI experts and thank them with nice lunches or drinks!

Don't overanalyze. Try to strike a good balance between quality and speed. It's also important to allocate resources wisely between short-term fire drills and longer-term step-function initiatives.

Develop a structured diagnosis framework over time. More metrics could mean that more things could go wrong or look wrong. The team needs to develop the right framework to know what types of things (such as macro economy, ads platform incidents, payment system issues) can go wrong and how to analyze one category at a time versus boiling the ocean for every small signal. If feasible, building upper/lower limits to detect outliers systematically could be helpful. It's also important to log each incidence to understand the usual offenders. As the team accumulates enough knowledge, a mind map or decision tree could be built to guide the diagnosis and quickly get to the root cause.

Happy analyzing!